Yesterday’s announcement that Marston’s is acquiring the Charles Wells Brewing and Beer Business for £55 million and loose change (or “working capital adjustments”), at a pretty conservative 5.5 times ebitda, adds another five historic old brewery names, Courage, McEwans, Young’s, William Younger’s and Wells, to a portfolio that already reads like the line-up at a quite good small beer festival circa 1990: Marston’s itself, Banks’s, Jennings, Thwaites, Ringwood, Wychwood, Brakspear, Mansfield, Mitchells (with Lancaster Bomber) and, if you include beers Marston’s brews under licence, Bass and Tetley.

It will give the company six working breweries, and more than 50 “ale” brands, from Bank’s mild to McEwan’s Champion. That’s around twice as many as its closest rival, Greene King, which runs just two breweries, its own original home in Suffolk and Belhaven in Scotland, and continues brewing under the names of just five vanished brewers: Morlands, Ruddles, Ridleys, Hardy’s & Hansons and Tolly Cobbold. On the retail side, however, Greene King owns around 3,100 pubs and bars, making it the third biggest operator in the country, Marston’s “just” 1,750 or so, meaning it vies with Mitchells & Butlers for fourth place.

So what’s with Marston’s policy of adding ever more seemingly pretty similar “twiggy brown bitters” to its line-up? I interviewed the company’s chief executive, Ralph Findlay, two years ago, right after Marston’s had acquired Thwaites’s beer portfolio and made those beers available to all its pubs, and he was pretty specific about the desire to increase further his already considerable ale offer: “Choice is where the market is at,” Findlay said. “Range is something you simply have to have, both for licensees and their customers.” Even after the Thwaites acquisition, he said. Marston’s would continue to look for “opportunistic” purchases if they came up: “We look at potential acquisitions that are consistent with our strategy and which can contribute to our return on capital. We have had a strategy over the past five years that’s not been reliant on acquisitions, though we’ve made them when it’s been opportunistic to do so, such as the acquisition of the Thwaites brewing business. I think we’re in the fortunate position of having an incredibly strong beer range from the various breweries that we’ve got. It’s a strategy that is undoubtedly working.”

Why not, like others, just buy in beers, rather than buy breweries? Because, as Findlay says, it’s a strategy that is working. Marston’s also revealed its half-year figures yesterday. Own-brewed beer volumes were up two per cent, in a declining market. Sales were up three per cent, to £440.8m. Average profit per pub was up three per cent. Like-for-like sales were up between 1.6 and 1.7 per cent. More City analysts than not continue to have the company as a “buy”.

Should we mourn the capture of more beer brands by one large company? Not in this case, I believe, and the reason is something you probably don’t know, because Marston’s has never, curiously, made a big parade about it. Five or so years ago, Marston’s brewers made a mighty oath that they would not let any of their beers continue to go on sale in clear glass bottles, believing that the dangers of the product they poured their hearts into being light-struck and skunky through not using brown bottles was too great. The company’s marketeers accepted the brewers’ ruling, something that brewers at no other large UK ale brewery, apart from Fuller’s have been able to achieve: Greene King, Shepherd Neame, Hall & Woodhouse, all sell some or several of their beers in clear bottles, and even Charles Wells has at least one several of its brands, includingWaggle Dance (originally, history fans, made by Wards of Sheffield Vaux of Sunderland, then Vaux, then Young’s, and thus about to be on its fourth fifth owner) and the Burning Gold iteration of Bombardier (as the Beer Nut reminded me) in flint glass. The commitment by Marston’s to beer quality ahead of spurious marketing arguments about how consumers are supposedly encouraged to buy beers that they can see the colour of makes me more confident that Wells’s brand are in relatively safe hands under the boys from Wolverhampton.

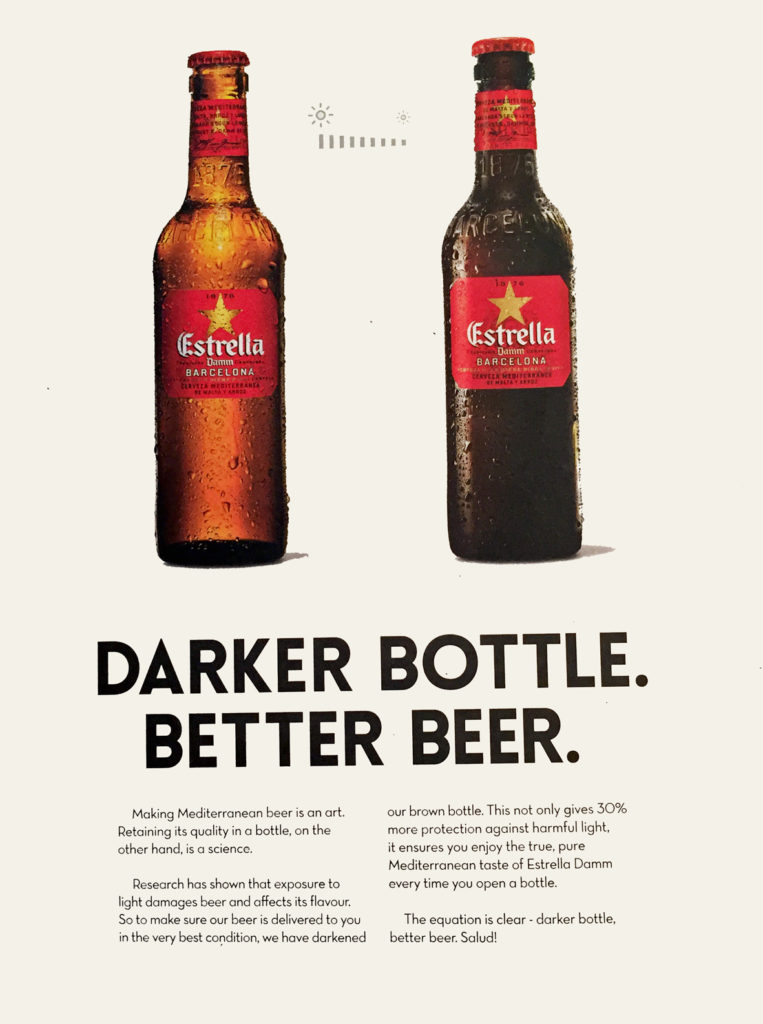

Ironically, or at least I think it’s ironic, one of the brands Marston’s is acquiring distribution rights to via the Wells purchase, the Spanish lager Estrella, has just been running an ad campaign un the UK under the slogan “Darker bottle, better beer”, explaining to consumers that “research has shown that exposure to light damages beer and affects its flavour”, and for that reason it was darkening its bottles by 30 per cent.

I’m slightly puzzled that Charles Wells has said that, while it will now be concentrating on its pub estate, it will also be building a new small brewery in Bedford to brew the Charlie Wells “craft beers” and John Bull range, which it is not selling to Marston’s. Is this continued toehold in the brewing world a way of appeasing the family shareholders (many of them formidable elderly females who, Paul Wells once told me, all had his phone number and would ring him up when they felt the company’s figures weren’t good enough) who might try to vote down the sale of the main brewing operation if they felt the company was cutting off its roots after 141 years of supplying beer to the people of Bedford?

Charles Wells currently brews several beers I’m very fond of, including Courage Imperial Russian Stout, Young’s Winter Warmer and McEwan’s Champion, that will now be brewed under Marston’s control. For probably the only time ever, I’m going to let Tim Page, chief executive of Camra, speak for me: giving a cautious one thumb up to the takeover, he said yesterday: “Marston’s has a positive track record of keeping the breweries it acquires open, in situ, and in many cases investing in the sites to increase capacity, and we urge them to continue that policy. We’d also encourage them to protect the brands that they have acquired and increase the range available to beer drinkers, by continuing to supply them alongside the existing beers produced by Marston’s owned breweries.”

One error? – did Waggledance originate at Wards (Sheffield) and then move to Vaux when they closed the awards Brewery?

I do believe you’re right, thank you, corrected

Martyn – thanks – I recall a visit to Wards in late 1990’s when they had large tubs of honey ready for the Waggledance.

Funnily enough the new bottle-conditioned Pedigree, although it’s in brown glass, tastes as if it’s been sitting on a kitchen windowsill in a jam jar for a month.

Marstons have been a good custodian of the breweries and beers they’ve collected. To see evidence of that track record you only have to take the example of how much cash was thrown at the twice-flooded Jennings brewery which was certainly ripe for the easier option of closure. The only concern I have is that all those eggs in one basket are at risk from any future change in direction the company might embark on as a result of, say, market forces, or shareholder pressure.

I agree that Marston’s are to be commended for keeping the Jennings Brewery open after the flooding, but I can’t agree that Marston’s is a “good custodian” of the beer brands in its portfolio.

Since the takeover, the flavours of the Jennings beer range have not only become mostly unrecognisable in character but also hugely inferior in quality.

When I first started drinking Jennings (around 20 years ago), all of their beers – especially the cask-conditioned versions – were absolutely superb. Distinctive and packed with layers of subtle, delicious flavours.

My suspicion is that Marston’s ownership has led to the use of cheaper, inferior ingredients and/or cost-saving changes to the recipes such as shorter boil times, shorter conditioning times, etc. Something drastic has happened that can’t be explained by poor cask handling or cellar management.

Each time I’ve sampled (in vain hope!) a pint or bottle of Jennings in recent years, the beer was bright and there were no sour or ‘tired’ flavours attributable to poor handling. But each beer in the range is totally unrecognisable in character compared to the Jennings I used to enjoy so much. One of the very best overall ranges of beers in England is now probably the blandest range of beers I’ve ever tried!

I’m not familiar with the entire range of beers in the Marston’s group range, but I reckon much of the distinctive flavour of Pedigree has also been lost, albeit to a less severe extent. It’s still fairly pleasant, but nothing special. I’ve tried it in bottle and on draught this year, for the first time in a long time, and both were lacking much of the character I’ve always recognised as the hallmarks of Pedigree, including the famous sulphurous aroma and underlying mineral flavours of the local water. Have Marston’s started pre-treating their brewing liquor to remove those flavours?

Owd Rodger is the only Marston’s beer I thoroughly enjoy now. I’m only a fairly recent fan so can’t comment on how its current flavour compares to recent decades, but my father’s verdict is that it definitely tastes somewhat different compared to when he drank it in the 1950s-1970s, but he still likes it.

Wainwright is still a decent drink but didn’t it have a bit more body/mouthfeel and flavour when it was first launched by Thwaites?

I’m curious to try Banks’s Mild again, which I used to very much enjoy in the mid 90s when I lived in the Midlands. I hope it still has the lovely deep, biscuity malt flavour I most remember it for.

Which Marston’s-owned beer brands would you say are as good as ever?

When Marston’s took over Jennings it was cash starved and on the verge of bankruptcy. I know, because I worked there, although a little over 20 years ago. Most of the cask beers would go off in a heartbeat and the beers were inconsistent because the ancient brewery desperately needed refurbishing, although when in good nick they were indeed delicious. Re Pedigree, I can’t remember the last time I even heard of a pint having the Burton Snatch although as far as I know most Pedigree is produced in ordinary fermenters, with the good stuff – union-brewed – only going to pubs within a certain radius of the brewery. As to your last question – you may have a point there!

Surely can’t be good news for either the Wells brands or competition in the industry in the long term, though.

And Wells put a considerably higher proportion of their beers in brown bottles than Greene King or Shepherd Neame do.

While they may not put their own brands in clear bottles, Marston’s do for own-label beers such as those they supply to Tesco.

Marstons are one of the few UK brewers (large ones, I mean) that are running at capacity. In effect, they have two large breweries – Burton and Wolverhampton – the others are small enough to be filled by the ‘parent product’ for example, Wychwood is so small it can’t brew all the Wychwood beers. So too Ringwood, Jennings etc. The issue though is that the capacity isn’t owned beer – their at capacity because of their contract brewing. So if these contracts move away, or Marston’s pull out because of say, declining profitability, that’s where this deal becomes a problem. That’s when they will have to look to consolidate their breweries. Let’s hope their current strategy continues then and they can keep growth in their own beers. That feels like a tough challenge.

I am happy that these brands are now under the stewardship of Marston’s. For now. But what if a new generation decides to go for short term profits? The list is long – Young’s of Wandsworth cashed in on its brewery, a new generation of the Bateman family simply wanted the cash, and there was a time when Watney’s and Whitbred’s were reputable brewers – of beer not coffee! The list is endless. We may regret this in ten or twenty years.