Rush out now and buy as much Gale’s Prize Old Ale as you can

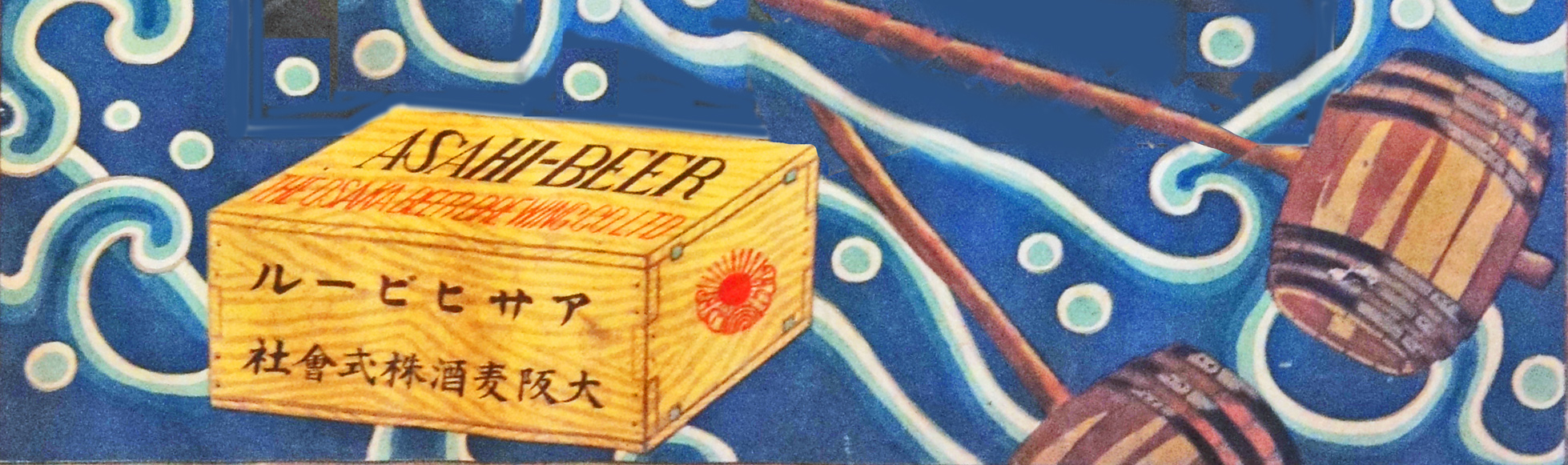

The news that the Japanese brewing giant Asahi will be closing the Dark Star brewery in Sussex, which it acquired with the purchase of Fuller’s brewery in West London in 2019, is, of course, a tragedy for the people who work there – a Sussex martlet tells me that no attempt is being made to… Read More Rush out now and buy as much Gale’s Prize Old Ale as you can