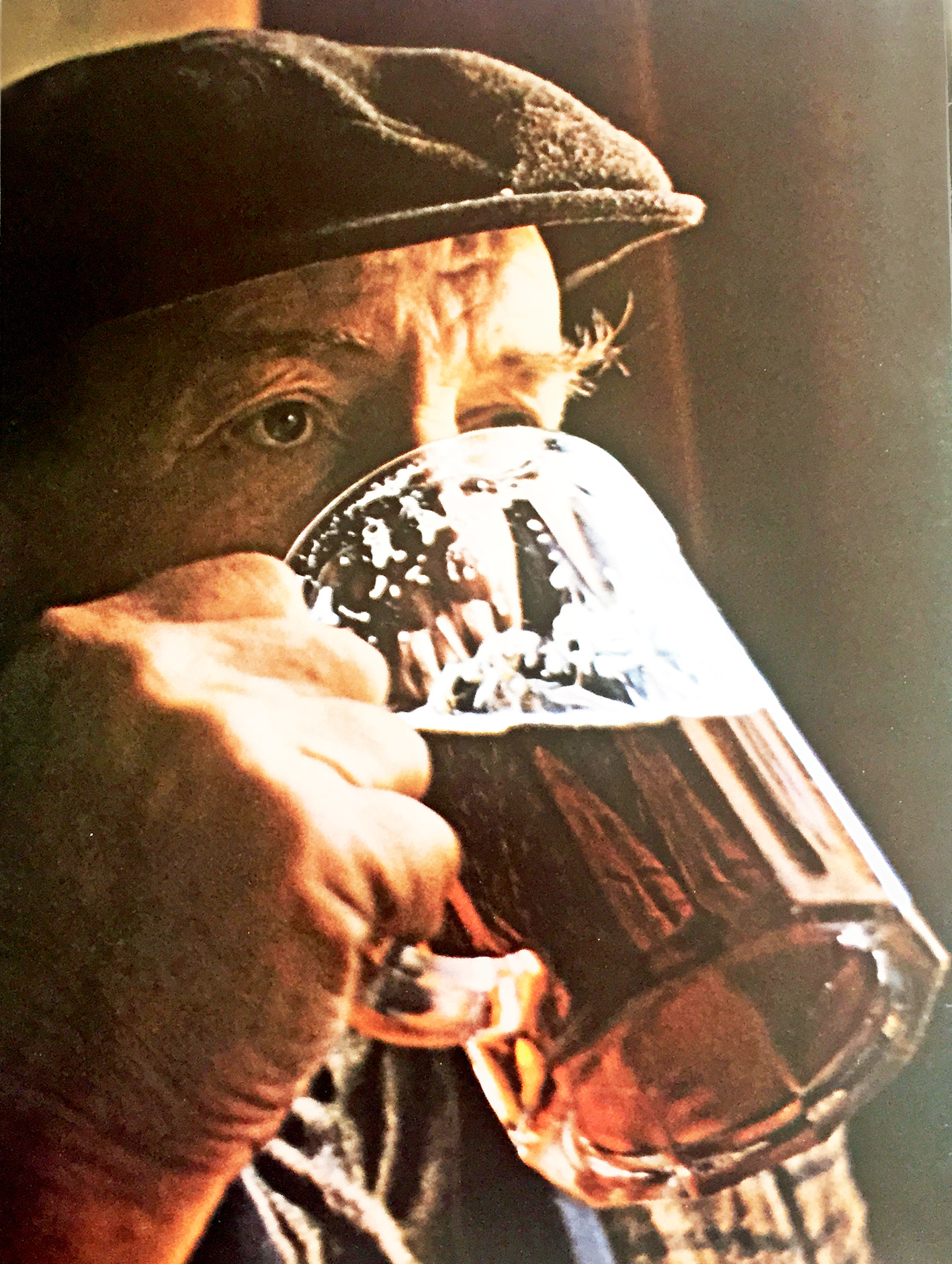

Why, nearly 50 years after the birth of Camra, can I still not be guaranteed a decent pint of cask beer in most pubs?

Why is finding a properly kept pint of cask ale such an appalling lottery in Britain’s pubs, despite the existence since 1971 of a consumer organisation dedicated to beer quality – before most pub staff were born – and the existence of a trade organisation dedicated to raising the standards of draught beer, Cask Marque,… Read More Why, nearly 50 years after the birth of Camra, can I still not be guaranteed a decent pint of cask beer in most pubs?